Outsourced bookkeeping can bring the perfect solution to one of the biggest challenges of running your own business: keeping your finances in order. In this guide, we’ll explore everything you need to know about outsourced bookkeeping services, with a special focus on the needs of small businesses in Texas.

What is outsourced bookkeeping?

Bookkeeping is the process of recording financial transactions, and it is essential for small businesses. It isn’t just about jotting down numbers. Imagine you’re tuning into the heartbeat of your business, feeling its financial pulse, gaining a deep understanding of its financial vitality.

Outsourced bookkeeping services means hiring a professional outside of your company to handle this crucial task. It’s a strategic decision that can save time, reduce costs, and provide access to expert knowledge.

Why outsource bookkeeping?

Outsourced bookkeeping serves as a powerful safeguard against internal theft within a business with a clear and impartial set of eyes on company financial records. This added layer of oversight can help identify irregularities or discrepancies that might otherwise go unnoticed.

Professional bookkeeping services follow strict rules and have best practices to keep your financial records accurate and trustworthy. This discourages employees who have direct access to cash from being tempted to steal from the company.

Here’s another important reasons why you should outsource your bookkeeping:

- It saves time: Outsourcing saves time, allowing you to focus on growing your business, be with your family or do the things you enjoy. In a place like Texas, where opportunities abound, time is of the essence.

- It gives you access to professional expertise: Receive expert advice without hiring a full-time accountant. Benefit from the knowledge of professionals who understand the unique business landscape in Texas.

- It gives you cost-effective solutions: Often cheaper than maintaining an in-house team. Outsourcing allows you to only pay for what you need.

- It guarantees compliance with tax laws and regulations: Stay up-to-date with Texas tax laws. This is vital, as local regulations can be complex and ever-changing.

When to consider outsourced bookkeeping

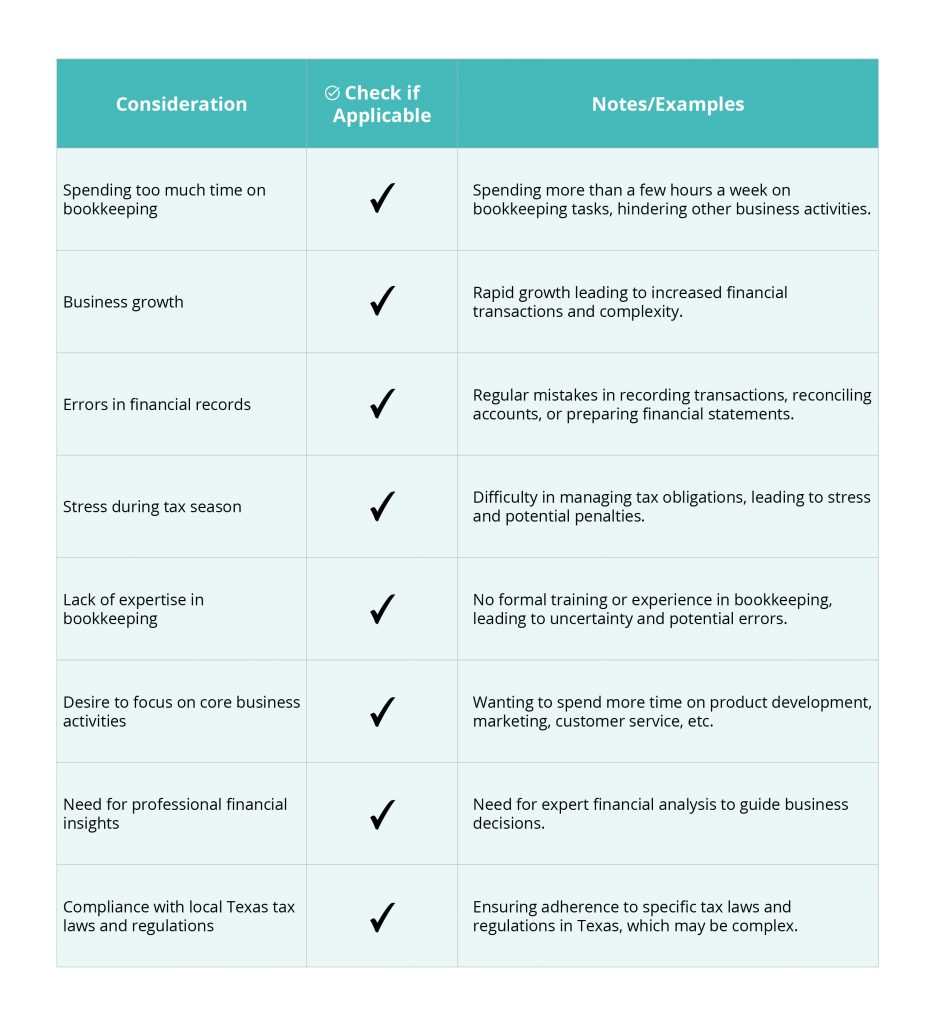

If you find yourself spending too much time on bookkeeping or if your business is growing to the point where DIY bookkeeping is becoming a challenge, it might be time to consider outsourcing. Other signs you should pay attention to might include errors in financial records, stress during tax season, or simply a growing desire to focus more on core business activities.

Below is a comparative table that small business owners can use as a checklist to decide if it’s time to consider outsourced bookkeeping services. This table includes real examples of situations and signs that might indicate the need for outsourcing.

If you checked three or more, it might be time to consider outsourcing your bookkeeping services.

How does outsourced bookkeeping work?

Once you decide to outsource your bookkeeping the process will start with a clearly defined scope of work – an understanding of what your bookkeeper will be doing for your business.

You’ll need to decide if you’re going to outsource to a virtual or local bookkeeper.

Virtual bookkeeping is done online, using technology to provide a more modern, convenient and seamless service. At LedgersKept Bookkeeping we can provide you with a complete outsourced bookkeeping service.

We start by making sure that you’re set up on a modern cloud accounting platform like Xero or QuickBooks to provide a secure method for recording, managing and reporting your finances.

Most outsourced bookkeeping services will also use handy apps that integrate into your accounting software to remove the burden of receipts and paperwork, and to streamline your bookkeeping.

Your bookkeeper will then communicate with you about any daily, monthly, quarterly and annual tasks required to keep your business finances in order.

Types of outsourced bookkeeping services

When looking for outsourced bookkeeping services, you’ll have a few options:

- Local bookkeepers: They understand the community in which you do business..

- Virtual bookkeepers: Providing online bookkeeping solutions, they offer flexibility, frequently come with reduced expenses, and often possess an understanding of the nationwide market because they work with clients in multiple locations.

- Full-service accounting firms: A CPA firm will provide a more comprehensive solution, and can handle everything from daily transactions to tax resolution, but most CPA firms charge a higher rate.

- Industry-specific expertise: Some bookkeepers specialize in specific industries like eCommerce, veterinary or construction, offering tailored solutions.

How to choose the right outsourced bookkeeping service

Choosing an outsourced bookkeeper is not just about cost but also about the quality and reliability of their service.

Key considerations include the provider’s experience, especially with Texas businesses. You want someone who understands local regulations, sales tax, and market dynamics.

Transparent pricing is another vital factor. Make sure there’s a clear understanding of what you’ll pay and what services are included.

The technology used by the provider can also play a significant role, as you’ll benefit from an outsourced bookkeeping service that knows how to be more efficient with the use of modern tools.

How much does it cost to outsource bookkeeping?

The cost of outsourcing bookkeeping can vary widely and depends on several factors. The complexity of your business, the volume of transactions, and your specific needs all play a role in determining the final cost. Often, businesses find that outsourcing is more affordable when compared to the overheads of in-house costs.

Different pricing models cater to different business needs. For instance, hourly rates might be suitable for businesses with fluctuating needs, while monthly subscriptions could be ideal for those requiring consistent bookkeeping services. For businesses with unique requirements, custom packages can offer tailored solutions that fit their specific needs.

At LedgesKept we provide a fixed-rate monthly subscription that takes care of all your bookkeeping needs and financial statement preparation. Contact us for pricing.

Leave a Reply